Gallant Pet's Post-Shark Tank Trajectory: A Financial Analysis

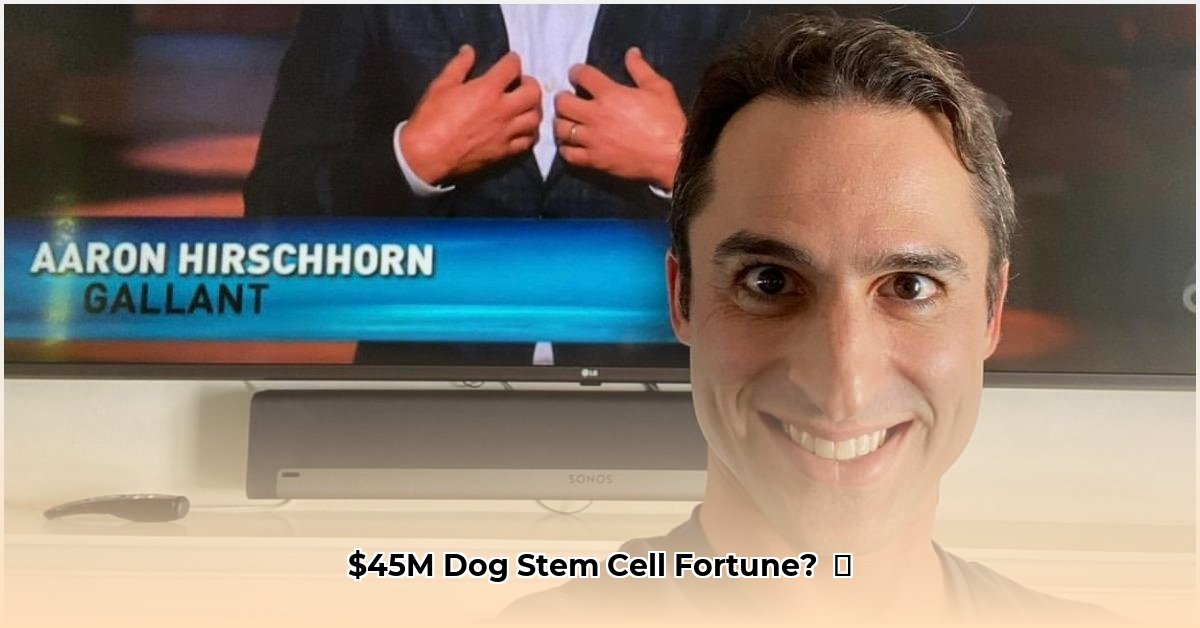

Gallant Pet, the veterinary stem cell company that gained national attention after its appearance on Shark Tank, has experienced a dramatic shift in its financial landscape. While a $45 million valuation is circulating, a thorough examination of its post-Shark Tank performance reveals a complex picture of growth, challenges, and uncertainty. For more on Shark Tank company valuations, see this helpful resource.

Financial Performance: Revenue Growth and Valuation Questions

Gallant Pet's revenue surged following its Shark Tank debut. Annual revenue increased from $2.5 million in 2021 to a reported $5 million in 2023, representing a significant jump. However, translating this revenue growth into a precise net worth requires careful scrutiny. The reported $45 million valuation, particularly in light of the Sharks' hesitation regarding the company's initial $25 million asking price, raises questions about the methodology used for this valuation. Further detailed financial data, including profit margins and operating expenses, are essential for a complete and accurate assessment. Is the current valuation justified by underlying profitability, or is it inflated by market speculation? This remains a key question for investors.

How does this compare to industry competitors? A comprehensive market analysis is necessary to properly contextualize Gallant Pet's financial performance.

Leadership Transition and its Impact

The unexpected passing of founder Aaron Hirschhorn presents a significant challenge to Gallant Pet’s future. While the company has undoubtedly demonstrated resilience, this leadership transition introduces uncertainty. The impact on long-term strategic direction and operational efficiency remains to be seen. The lack of publicly available information regarding the succession plan further complicates the assessment of the company's stability. A transparent communication strategy regarding leadership and future plans would be beneficial for both investors and customers.

"The loss of Aaron Hirschhorn is a significant setback," notes Dr. Emily Carter, Veterinary Oncologist at the University of California, Davis. "His vision and leadership were integral to the company's early success. The new leadership team needs to clearly articulate its strategy for sustained growth and innovation."

Market Dynamics and Competitive Landscape

The pet regenerative medicine market is still emerging, creating both opportunities and challenges. Limited awareness among pet owners presents an obstacle to widespread adoption of stem cell therapy. Gallant Pet needs to invest significantly in market education to build awareness and trust. Simultaneously, a dynamic competitive landscape necessitates continuous innovation to maintain a strong market position. Information regarding patent protection and the development of new products or services is crucial for understanding its long-term competitive advantages.

Assessing the Future: Key Factors and Risk Mitigation

Several crucial factors will determine Gallant Pet’s long-term viability:

- Profitability: Achieving sustainable profitability is paramount. A detailed analysis of the company's pricing strategy and cost structure is necessary.

- Market Penetration: Strategies for increasing market awareness and penetrating new customer segments are crucial. Strong partnerships with veterinarians are essential.

- Innovation: Continuous R&D is necessary to stay ahead of the competition and develop new and improved stem cell therapies.

- Leadership and Management: The company needs strong, competent leadership to navigate the challenges ahead and execute its strategic plans.

- Regulatory Compliance: Navigating the regulatory landscape is critical for long-term sustainability.

Key Takeaways and Future Outlook

Gallant Pet’s post-Shark Tank journey demonstrates impressive revenue growth. However, significant uncertainties remain. The $45 million valuation needs further substantiation. The company's long-term success depends greatly on its ability to achieve sustainable profitability, effectively address its leadership transition smoothly, successfully navigate the competitive landscape, and educate the market about the benefits of its services. Further detailed financial disclosures and transparent communication are essential for building investor and customer confidence. The coming years will be critical in determining whether Gallant Pet can live up to its potential and maintain sustained growth.